Financial wellness for all

Financial wellness for all

Learn how to

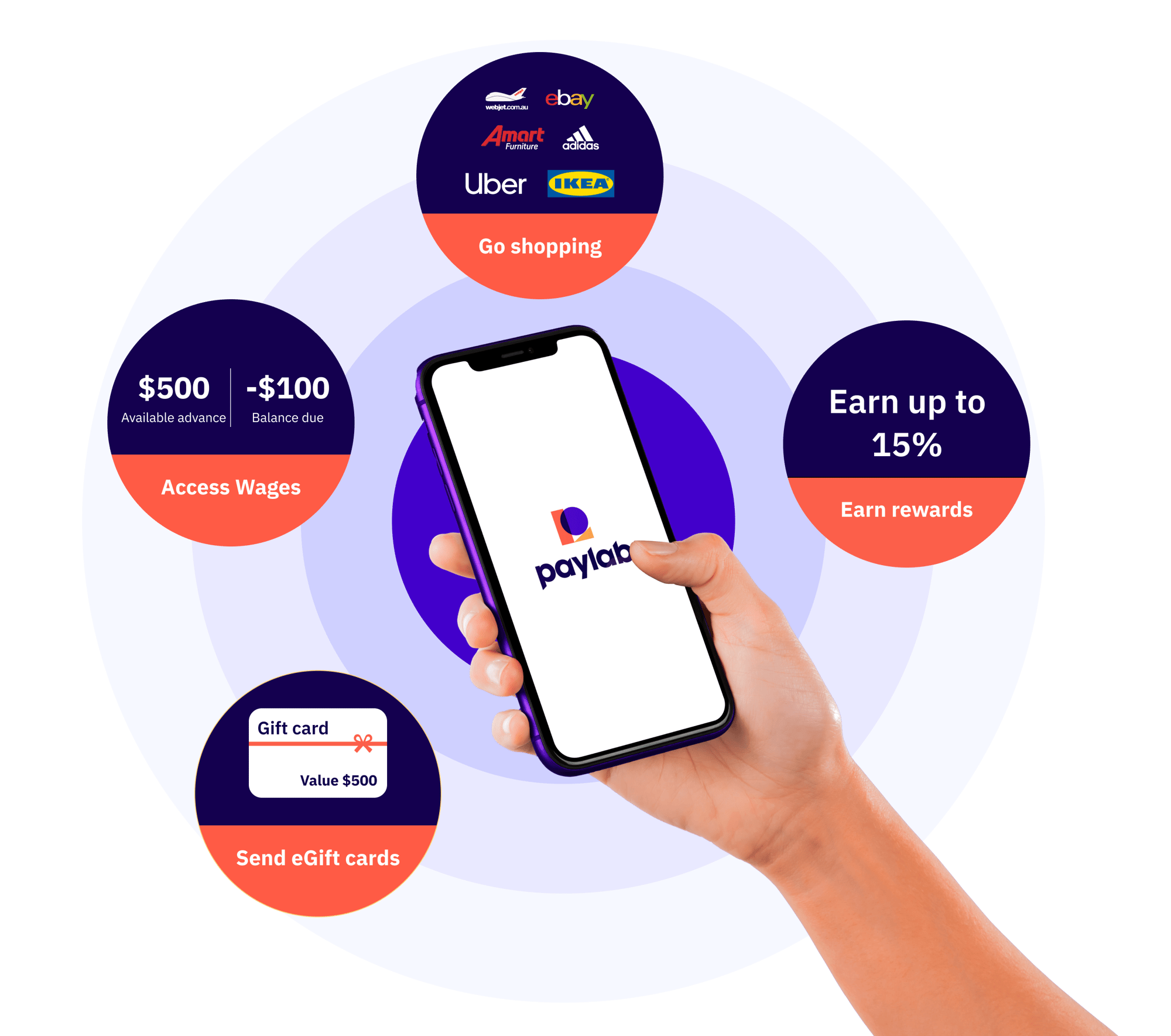

Borrow, Spend and Save - All in one Platform

-

#1 Download and Sign up on Paylab

Download the Paylab app from the Google Play Store or Apple App Store and sign up within minutes. Once you're in, you'll have to access Paylab Advance and Rewards.

-

#2 Apply for Paylab Advance and Get Approved

Select the Paylab Advance option and start your assessment. Simply link your bank account (where your wages are deposited) and we'll do a quick review. Based on your cash flow, we’ll show you how much you can access - no credit checks, no stress!

-

#3 Verify your Identity

For security, we’ll ask for a few details - your name, date of birth and address (just as they appear on your ID). Upload your Australian passport or driver’s license and we’ll handle the rest with a quick verification.

-

#4 Get your Advance & Repay Easily

Once verified, choose the amount you need (up to your limit), approve the loan agreement and your funds will be sent straight to your bank account - usually within minutes. Repayment is automatic and scheduled for your next payday, so you don’t have to worry about a thing.

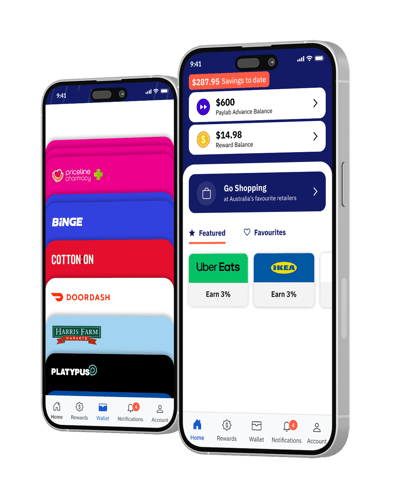

Maximise your Savings

Offset the one-time 5% Paylab Advance fee by using your advance to purchase discounted eGift cards in the Paylab app. Save on everyday purchases and maximise your benefits!

Am I eligible for an Advance?

In order to apply for an advance on Paylab, you must:

- be currently employed with a regular income deposited into a bank account

- have Australian Driver’s License or Australian Passport

- specify your pay cycle (eg: weekly, fortnightly)